Use these links to rapidly review the documentTable of ContentsTABLE OF CONTENTS

6, 2024 help make this meeting format as efficient as possible. ” ” What is a quorum? Meeting by visiting www.virtualshareholdermeeting.com/TWLO2024 (have your Notice or proxy card in hand when you visit the website). physical mail to help ensure prompt receipt of any communications related to voting. online? the technical support telephone number posted on the virtual meeting website login page. you; these unvoted shares are counted as “broker non-votes.” Proposals 1, 3, 4, and 5 are considered to be “non-routine” under NYSE rules and we therefore expect broker non-votes to exist in connection with those proposals. Proposal 2 is a “routine” matter and therefore broker non-votes are not expected to exist in connection with this proposal. : 12, 2025. In addition, our Directors with Terms Expiring at the Annual Meeting/Nominees Richard Dalzell(1) Scott Raney†(2) Erika Rottenberg(1)(2)(3) Continuing Directors Jeff Lawson Byron Deeter Elena Donio(3) James McGeever(2)(3)

the (AmendmentFiled by the Registrant ý ☒

Partyparty other than the RegistrantoCheck the appropriate box:oPreliminary Proxy StatementoConfidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))ýDefinitive Proxy StatementoDefinitive Additional MaterialsoSoliciting Material under §240.14a-12

☐☒ Twilio Inc.(Name of Registrant as Specified In Its Charter)(Name of Person(s) Filing Proxy Statement, if other than the Registrant)Payment of Filing Fee (Check the appropriate box):ý

No fee required.oFee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.required ☐ (1)Title of each class of securities to which transaction applies:(2)Aggregate number of securities to which transaction applies:(3)Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):(4)Proposed maximum aggregate value of transaction:(5)Total fee paid:o

Fee paid previously with preliminary materials.oCheck box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.(1)Amount Previously Paid:

materials ☐ (2)Form, Schedule or Registration Statement No.:(3)Filing Party:(4)Date Filed:

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14A-6(i)(1) and 0-11Table

Contents

TWILIO INC.375 BEALE STREET, SUITE 300SAN FRANCISCO, CALIFORNIA 94105NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Annual Meeting of Stockholders98:30 a.m. Pacific Time on Monday, June 12, 2017

20172024 annual meeting of stockholders (the "Annual Meeting"“Annual Meeting”) of Twilio Inc., a Delaware corporation, which will be held virtually onMonday,June 12, 20176, 2024 at 98:30 a.m. Pacific Time via live audio webcast at Four Embarcadero Center, Promenade Level, Stanford Room, San Francisco, CA 94111www.virtualshareholdermeeting.com/TWLO2024, for the following purposes, as more fully described in the accompanying proxy statement: 1. To elect two Class I directors to serve until the 2020 annual meeting of stockholders and until their successors are duly elected and qualified; 2. To ratify the appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2017; 3. To ratify our 2016 Stock Option and Incentive Plan to preserve our ability to receive corporate income tax deductions that may become available pursuant to Section 162(m) of the Internal Revenue Code of 1986, as amended (the "Code"); and

1. To elect the three Class II directors named in the proxy statement to serve until the 2027 annual meeting of stockholders and until their successors are duly elected and qualified;

2. To ratify the appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2024;

3. To approve, on a non-binding advisory basis, the compensation of our named executive officers;

4. To indicate, on a non-binding advisory basis, the preferred frequency of future non-binding advisory votes to approve the compensation of our named executive officers;

5. To approve a management proposal to amend our certificate of incorporation to declassify the board of directors; and

6. To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. any adjournments or postponements thereof. With respectby mail to the election of the Class I directors, Scott Raney has notified our board of directors that he will not stand for reelection to the board of directors at the Annual Meeting. Mr. Raney has served on our board of directors since 2013, and we thank him for his years of service.17, 201715, 2024 as the record date for the Annual Meeting. Only stockholders of record on April 17, 201715, 2024 are entitled to notice of and to vote at the Annual Meeting. Further information regarding voting rights and the matters to be voted upon isare presented in the accompanying proxy statement. On or about April 24, 2017, we expect to mail to our stockholders a Notice of Internet Availability of Proxy Materials (the "Notice") containing instructions on how to access ourfor our 2017 Annual Meeting of Stockholders (the "Proxy Statement") and our Annual Report on Form 10-K for the fiscal year ended December 31, 2016 (the "Annual Report"). The Proxy Statement and the Annual Reportannual report can be accessed directly at the following Internet address: http://materials.proxyvote.com/90138F. All you havewww.proxyvote.com. You will be asked to do is enter the 16-digit control number located on your proxy card.via the Internet, telephone or mail as soon as possible to ensure that your shares are represented. For additional instructions on voting by telephone or the Internet,how to vote your shares, please refer to your proxy card. ReturningVoting your shares by proxy prior to the proxyAnnual Meeting does not deprive you of your right to attend the Annual Meeting and to vote your shares at the Annual Meeting. We appreciate your continued support of Twilio.By order of the Board of Directors,

Jeff LawsonCo-Founder, Chief Executive Officer and Chairperson of the BoardSan Francisco, CaliforniaApril 24, 2017By order of the board of directors, PROCEDURAL MATTERS 1

2024 Proxy Statement

Table of Contents

2024 Proxy Statement TWILIO INC.PROXY STATEMENTFOR2017 ANNUAL MEETINGTABLE OF STOCKHOLDERSCONTENTS

20172024 annual meeting of stockholders of Twilio Inc., a Delaware corporation (the "Company"(referred to in this proxy statement as “Twilio,” the “Company,” “we,” “us,” or “our”), and any postponements, adjournments or continuations thereof (the "Annual Meeting"“Annual Meeting”). The Annual Meeting will be held on Monday, June 12, 2017, at 9:00 a.m. Pacific Time at Four Embarcadero Center, Promenade Level, Stanford Room, San Francisco, CA 94111. The Notice of Internet Availability of Proxy Materials (the "Notice") containing instructions on how to access this proxy statement and our annual report is first being mailed on or about April 24, 2017 to all stockholders entitled to vote at the Annual Meeting. The information provided in the "question and answer" format below is for your convenience only and is merely aof thehighlights information contained elsewhere in this proxy statement. YouThis summary does not contain all of the information you should consider, and you should read thisthe entire proxy statement carefully.carefully before voting. Information contained on, or that can be accessed through, our website is not intended to be incorporated by reference into this proxy statement and references to our website address in this proxy statement are inactive textual references only.What matters am I voting on?

Management Proposals 1. The election of Jeff Epstein, Khozema Shipchandler and Andrew Stafman as Class II directors. FOR 2. The ratification of the appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2024. FOR 3. The approval, on a non-binding advisory basis, of the compensation of our named executive officers. FOR 4. The non-binding, advisory indication of the preferred frequency of future non-binding advisory votes to approve the compensation of our named executive officers. ONE YEAR 5. To approve a management proposal to amend our certificate of incorporation to declassify the board of directors. FOR 2024 Proxy Statement Proxy Statement Summary

• • • • • • • • 2024 Proxy Statement

Proxy Statement Summary • • • (1) Organic revenue growth, Communications organic revenue growth, Segment organic revenue growth, non-GAAP income (loss) from operations, and free cash flow are non-GAAP financial measures. Refer to Appendix B for their definitions and a reconciliation of each non-GAAP measure to its most directly comparable GAAP measure. 2024 Proxy Statement Proxy Statement Summary

* Excludes Mr. Deeter, who is not standing for re-election at the Annual Meeting. on:rights. 2024 Proxy Statement •

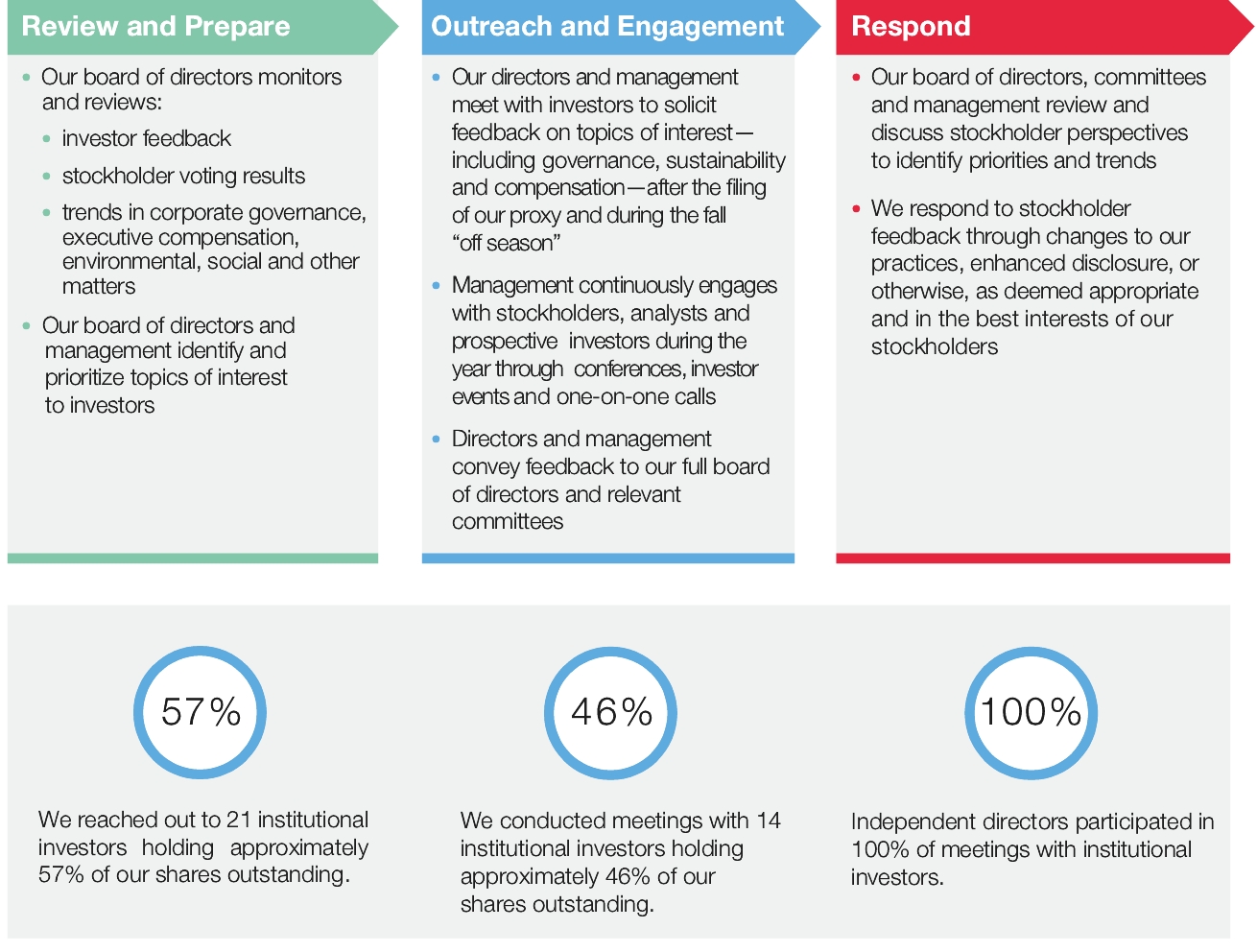

2024 Proxy Statement Stockholder Engagement

2024 Proxy Statement

Stockholder Engagement What We Heard How We Responded Company Strategy Increase share repurchase program Enhance financial reporting disclosures 2024 Proxy Statement Stockholder Engagement

What We Heard How We Responded Executive Compensation Incorporate longer performance periods for PSU awards Incorporate profitability metrics in compensation program Adopt a short-term incentive plan Corporate Governance Sunset our dual class structure Separate CEO and Board Chair roles 2024 Proxy Statement

Stockholder Engagement What We Heard How We Responded Environmental, Social, and Other Continue commitment to environmental and social issues Continue commitment to stockholder engagement (1) Non-GAAP income (loss) from operations and free cash flow are non-GAAP financial measures. Refer to Appendix B for their definitions and a reconciliation of each non-GAAP measure to its most directly comparable GAAP measure. 2024 Proxy Statement

2024 Proxy Statement

Our Commitment to Environmental, Social and Governance Matters

2024 Proxy Statement Our Commitment to Environmental, Social and Governance Matters

2024 Proxy Statement

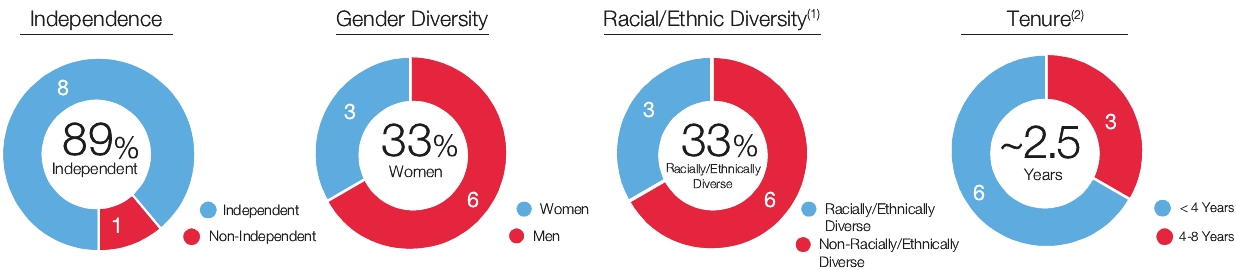

(1) Includes directors who identify in any of the following categories: African American or Black, Hispanic or Latinx, Asian, Native American or Alaskan Native, Native Hawaiian or Other Pacific Islander, or North African or Middle Eastern. (2) We have added four new independent directors since 2021. * Each of the graphics above excludes Mr. Deeter, who is not standing for re-election at the Annual Meeting. 2024 Proxy Statement Board of Directors and Corporate Governance

Class Age Independent Directors with Terms Expiring at the Annual Meeting/Nominees Jeff Epstein II 67 2017 2024 2027

Khozema Shipchandler II 50 2024 2024 2027 Andrew Stafman II 36 2024 2024 2027

Continuing Directors Charles Bell I 66 2023 2026 —

Donna Dubinsky III 68 2018 2025 —

Jeffrey Immelt I 68 2019 2026 —

Deval Patrick III 67 2021 2025 —

Erika Rottenberg I 61 2016 2026 —

Miyuki Suzuki III 63 2022 2025 —

Byron Deeter II 49 2010 2024

Committee Chair

Committee Member

Independent Board Chair 2024 Proxy Statement

Board of Directors and Corporate Governance Bell Dubinsky Epstein Immelt Patrick Rottenberg Shipchandler Stafman Suzuki

2024 Proxy Statement Board of Directors and Corporate Governance

2024 Proxy Statement

Board of Directors and Corporate Governance

2024 Proxy Statement Board of Directors and Corporate Governance

2024 Proxy Statement

Board of Directors and Corporate Governance

2024 Proxy Statement Board of Directors and Corporate Governance

2024 Proxy Statement

Board of Directors and Corporate Governance 2024 Proxy Statement Board of Directors and Corporate Governance

Board of Directors Independent Audit Committee Charles Bell

Byron Deeter

Donna Dubinsky

Jeff Epstein

Jeffrey Immelt

Deval Patrick

Erika Rottenberg

Khozema Shipchandler Andrew Stafman

Miyuki Suzuki

Independent Director

Committee Member

Committee Chair 2024 Proxy Statement

Board of Directors and Corporate Governance Audit Committee

No member of our audit committee may simultaneously serve on the audit committee of more than three public companies unless our board of directors determines that such simultaneous service would not impair the ability of such member to effectively serve on our audit committee.

Our audit committee, among other things:

Our audit committee held eight meetings during 2023. 2024 Proxy Statement Board of Directors and Corporate Governance

Compensation and Talent Management Committee

Our compensation committee held six meetings during 2023. 2024 Proxy Statement

Board of Directors and Corporate Governance Nominating and Corporate Governance Committee

Our nominating and corporate governance committee held four meetings during 2023. 2024 Proxy Statement Board of Directors and Corporate Governance

2024 Proxy Statement

Board of Directors and Corporate Governance 2024 Proxy Statement Board of Directors and Corporate Governance

2024 Proxy Statement

Board of Directors and Corporate Governance 2024 Proxy Statement Board of Directors and Corporate Governance

2024 Proxy Statement

Board of Directors and Corporate Governance Annual Equity Retainer for Board Membership (the “Annual Board Retainer”) $45,000 $30,000 Additional Annual Equity Retainer for Committee Membership: Chair Retainer Member Retainer Audit Committee $26,000 $13,000 Compensation and Talent Management Committee $20,000 $10,000 Nominating and Corporate Governance Committee $12,000 (1) In 2024, following the separation of the roles of Board Chair and Chief Executive Officer, our compensation committee conducted a review with Compensia of peer company board compensation trends, and our Non-Employee Director Compensation Policy was amended to provide a $75,000 annual retainer for the newly created role of Independent Board Chair. 2024 Proxy Statement Board of Directors and Corporate Governance

2024 Proxy Statement

Board of Directors and Corporate Governance Name Total ($) 636,395 636,395 Byron Deeter 325,158 325,158 Donna Dubinsky 332,740 332,740 Jeff Epstein 390,048 390,048 Jeffrey Immelt 340,374 340,374 Deval Patrick 318,791 318,791 Erika Rottenberg 345,807 345,807 Miyuki Suzuki 329,518 329,518 159,561 159,561 (1) Stock awards consist solely of RSUs. Annual Equity Grants and Annual Equity Retainers vest immediately upon grant. Initial Equity Grants vest in equal annual installments over three years, subject to any pro-ration as described above. The amounts reported in this column represent the aggregate grant date fair value of the RSUs awarded to the non-employee directors in 2023, calculated in accordance with FASB ASC Topic 718. The valuation assumptions used in determining such amounts are described in the Notes to our Consolidated Financial Statements included in our Annual Report on Form 10-K filed with the SEC on February 27, 2024. Each of Ms. Dubinsky and Messrs. Bell, Epstein and Patrick elected to defer a portion of the RSUs issued pursuant to each of their Quarterly Grants, which DSUs are reflected in the table above and shown separately in the table below. (2) As of December 31, 2023, the non-employee directors who served on our board of directors during 2023 had the following outstanding equity awards, in addition to the DSUs set forth in the table below: Mr. Bell held 5,744 RSUs; Mr. Patrick held 423 RSUs; and Ms. Suzuki held 4,406 RSUs. (3) Mr. Bell was appointed to our board of directors on March 28, 2023 and received an Initial Equity Grant of 6,428 RSUs. (4) Mr. Dalzell did not stand for re-election at the 2023 Annual Meeting of Stockholders. Accordingly, his service as a director ended on June 13, 2023. Name Accumulated DSUs Charles Bell 4,162 Donna Dubinsky 8,745 Jeff Epstein 28,901 Deval Patrick 8,496 2024 Proxy Statement

twohis or her successor, or such director’s earlier death, resignation or removal. Any increase or decrease in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of our directors. This classification of our board of directors may have the effect of delaying or preventing changes in the control of our company.III directors toat the Annual Meeting. If elected, each of Messrs. Epstein, Shipchandler and Stafman will serve as Class II directors until the 20202027 annual meeting of stockholders and until their successors are duly elected and qualified. Each of the nominees is currently a director of our company. For information concerning the nominees, please see the section titled “Board of Directors and Corporate Governance.” The Board of Directors recommends a vote “FOR” each of the nominees named above. 2024 Proxy Statement

2022 2023 (in thousands) $3,836 $5,655 311 — 40 — All Other Fees — — Total Fees $4,187 $5,655 (1) Audit Fees consist of professional services rendered in connection with the audit of our annual consolidated financial statements, including audited financial statements presented in our Annual Report on Form 10-K and services that are normally provided by the independent registered public accountants in connection with statutory and regulatory filings or engagements for those fiscal years, and the review of the financial statements included in our quarterly reports. Fees for fiscal year 2022 also consisted of fees related to consent filings and included work related to our equity method investment, impairment of long-lived assets, legacy system testwork and statutory audit of one of our international subsidiaries. Fees for fiscal year 2023 also included work related to our reportable segments, revenue of our Segment business unit, and restructurings. (2) Audit-Related Fees for fiscal year 2022 consisted of professional services rendered in connection with the due diligence of transactions or events, including equity method investment, and enterprise resource planning implementation. (3) Tax Fees for fiscal year 2022 consisted of fees billed for professional services for tax compliance, tax advice and tax planning. These services included assistance regarding federal and state tax compliance. 2024 Proxy Statement

2024 Proxy Statement

The Board of Directors recommends a vote “FOR” the approval, on a non-binding advisory basis, of the compensation of our named executive officers. 2024 Proxy Statement

The Board of Directors recommends that you vote for “ONE YEAR” as the preferred frequency of future non-binding advisory votes to approve the compensation of our named executive officers. 2024 Proxy Statement

The Board of Directors recommends a vote “FOR” the management proposal to amend our Certificate of Incorporation to declassify the Board of Directors. 2024 Proxy Statement

2024 Proxy Statement

Name Age Position Khozema Shipchandler 50 Aidan Viggiano 45 Dana Wagner 48 Chief Legal Officer, Chief Compliance Officer and Corporate Secretary (1) Mr. Shipchandler served as our Chief Financial Officer from November 2018 to October 2021, our Chief Operating Officer from October 2021 to March 1, 2023 and our President, Twilio Communications from March 1, 2023 to January 8, 2024, at which time he became Chief Executive Officer. (2) Ms. Viggiano served as our Senior Vice President, Finance from November 2021 to March 1, 2023, at which time she became Chief Financial Officer. 2024 Proxy Statement

• • • • • 2024 Proxy Statement

• • • • • • • • • • • (1) Organic revenue growth, Communications organic revenue growth, Segment organic revenue growth, non-GAAP income (loss) from operations, and free cash flow are non-GAAP financial measures. Refer to Appendix B for their definitions and a reconciliation of each non-GAAP measure to its most directly comparable GAAP measure. 2024 Proxy Statement

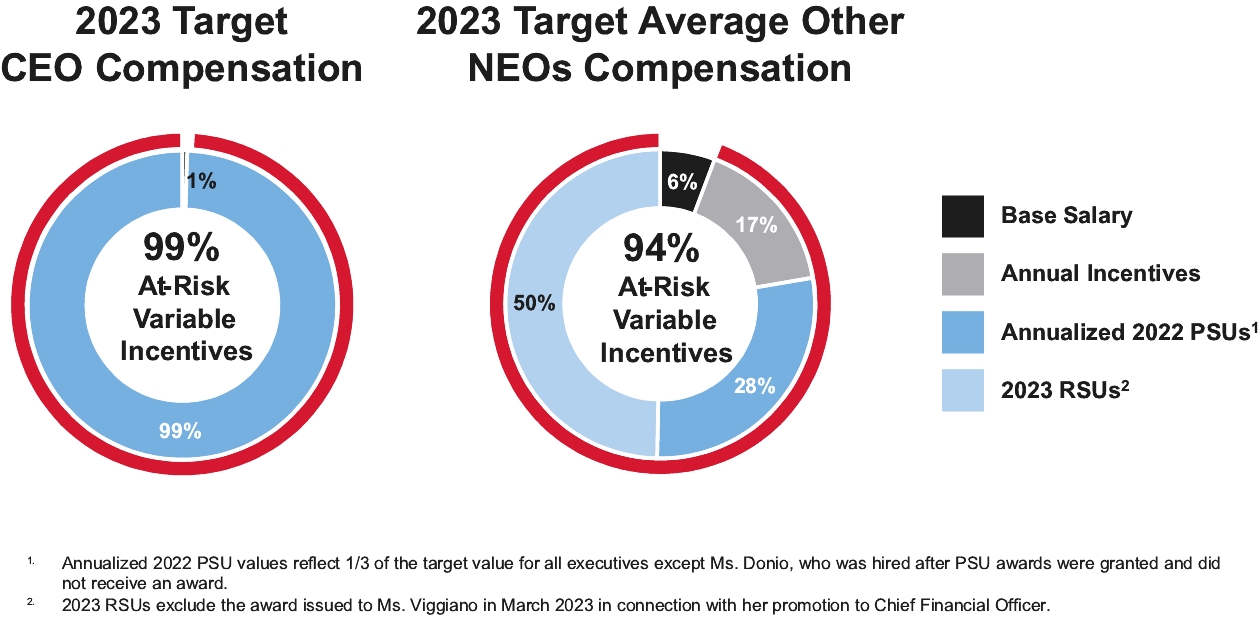

• • • Element 2023 Design Rationale Base Salary Reduced from $134,000 to $65,535, effective March 1, 2023 In consideration of stockholder feedback, recent company performance, and the magnitude of his 2022 PSU award, our Chief Executive Officer’s base salary was reduced and he did not receive any additional equity or performance-based cash awards in 2023. Annual Cash-Based Incentive None None 2024 Proxy Statement

Element 2023 Design Rationale Base Salary Consistent with the recommendation of our Chief Executive Officer, our compensation committee did not increase the base salaries of any of our named executive officers from their 2022 levels, other than for Ms. Viggiano, whose base salary was increased in connection with her promotion to Chief Financial Officer.

2024 Proxy Statement

2024 Proxy Statement

What We Heard How We Responded Pay and performance alignment Incorporate longer performance periods for PSU awards • In 2024, our compensation committee determined to reintroduce PSU awards and to incorporate a cumulative three-year performance period. The compensation committee’s rationale for reintroducing PSUs in 2024 is further discussed below in “2024 Executive Compensation Program Changes”. Incorporate profitability metrics in compensation program Adopt a short-term incentive plan 2024 Proxy Statement

Element Rationale Reintroduced PSU grants in 2024 to support our talent and business strategy Go-forward PSU design aligns with stockholder preferences Cash compensation is transitioning to a more market-normative structure We continued to evolve our peer group to match our business profile and size In late 2023, our compensation committee further refined our peer group referenced in setting 2024 compensation, adding more companies within the broader communications industry that also maintain software offerings to better align with our two business units and removing several companies that significantly exceeded our market capitalization range, which had the effect of reducing our market compensation benchmarks. 2024 Proxy Statement

Element Compensation Element Objective Base Salary Cash Attract and retain highly talented executives by providing fixed compensation amounts that are competitive in the market and reward performance. Performance-based cash awards Strengthen the performance-based core of our compensation program and enhance retention. Motivate executive officers to achieve annual performance goals that serve as the basis for long-term performance and stockholder value creation. Cash serves as an effective motivator in periods of market volatility while also reducing compensation-related stockholder dilution. Equity awards generally in the form of RSUs and PSUs Align the interests of executive officers and stockholders by motivating our executive officers to achieve long-term stockholder value creation. Strengthen pay-for-performance and enhance retention. 2024 Proxy Statement

WHAT WE DO WHAT WE DON’T DO 2024 Proxy Statement

WHAT WE DO WHAT WE DON’T DO 2024 Proxy Statement

2024 Proxy Statement

2024 Proxy Statement

2024 Proxy Statement

Ansys, Inc. Fortinet, Inc. Shopify Inc. Veeva Systems Inc. Arista Networks, Inc. Okta, Inc. Snap Inc. Workday, Inc. Autodesk, Inc. Palo Alto Networks, Inc. Snowflake Inc. Zoom Video Communications, Inc. Block, Inc. Paycom Software, Inc. Splunk Inc. CrowdStrike Holdings, Inc. RingCentral, Inc. Synopsys, Inc. DocuSign, Inc. ServiceNow, Inc. The Trade Desk, Inc. 2024 Proxy Statement

Named Executive Officer Jeff Lawson Aidan Viggiano Khozema Shipchandler $1,100,000 $1,100,000 Dana Wagner Elena Donio (1) Mr. Lawson’s base salary was reduced from $134,000 to $65,535 per year, effective March 1, 2023. (2) Ms. Viggiano’s base salary was increased to $850,000 per year, effective March 1, 2023, in connection with her promotion to Chief Financial Officer. Ms. Viggiano served as Senior Vice President of Finance from 2021 until her appointment as Chief Financial Officer in March 2023, and in 2022 Ms. Viggiano was not a named executive officer. (3) Ms. Donio stepped down from our board of directors and joined us as President of Revenue in May 2022; her base salary was established at that time. Ms. Donio’s 2023 base salary remained in effect during her continued employment following her stepping down as President, Twilio Data & Applications effective December 15, 2023. 2024 Proxy Statement

Named Executive Officer Jeff Lawson — Aidan Viggiano $2,750,000 Khozema Shipchandler $3,000,000 Dana Wagner $1,500,000 Elena Donio $3,000,000 Payout Level Target ≥$250 million 100% Threshold $200 million 50% <$200 million 0% * Subject to linear interpolation for performance between threshold and target. (1) Non-GAAP income from operations is a non-GAAP financial measure. Refer to Appendix B for its definition and a reconciliation of non-GAAP income from operations to its most directly comparable GAAP measure. 2024 Proxy Statement

Named Executive Officer Aidan Viggiano $2,750,000 Khozema Shipchandler $3,000,000 Dana Wagner $1,500,000 Elena Donio $3,000,000 2024 Proxy Statement

Named Executive Officer — — — 46,395 92,789 9,176,401 Khozema Shipchandler 50,613 101,225 10,010,679 Elena Donio 50,613 101,225 10,010,679 Dana Wagner 25,307 50,613 5,005,406 (1) The amounts reported in this column represent the aggregate grant date fair value of the RSUs granted to the named executive officer in 2023, calculated in accordance with FASB ASC Topic 718. Such aggregate grant date fair values do not take into account any estimated forfeitures related to service-vesting conditions. These amounts do not reflect the actual economic value that may be realized from such awards. The amounts reported for the RSUs were calculated using the closing price of our common stock on the date of grant. The valuation assumptions used in determining such amounts are described in the Notes to our Consolidated Financial Statements included in our Annual Report on Form 10-K filed with the SEC on February 27, 2024. (2) Mr. Lawson did not receive any 2023 Annual RSUs. (3) Excludes the award issued to Ms. Viggiano in March 2023 in connection with her promotion to Chief Financial Officer. See “—2023 Chief Financial Officer Promotional Award” for more information on such award. 2024 Proxy Statement

Payout Level Maximum 40% ≥$1.00 200% Target 30% ≥$1.00 100% Threshold 20% ≥$1.00 50% <20% ≥$1.00 0% * Subject to linear interpolation for performance between threshold, target and maximum. (1) Organic revenue growth and non-GAAP income from operations are non-GAAP financial measures. Refer to Appendix B for their definitions and a reconciliation of organic revenue growth and non-GAAP income from operations to their most directly comparable GAAP measures. 2024 Proxy Statement

2024 Proxy Statement

2024 Proxy Statement

Position Minimum Value Chief Executive Officer 6x base salary Other Named Executive Officers 3x base salary 2024 Proxy Statement

2024 Proxy Statement

2024 Proxy Statement

Name and principal position Year 2023 74,918 — — — — 1,941 76,859 2022 134,000 — 49,228,812 — — 14,657 49,377,469 2021 133,990 — 6,926,889 7,000,586 — 564,280 14,625,745 2023 793,462 — — 2,750,000 9,900 15,500,055 2023 1,100,000 — 10,010,679 — 3,000,000 9,900 14,120,579 2022 1,100,000 — 28,552,689 — — 8,304 29,660,993 2021 744,362 — 5,909,608 6,021,278 — 8,700 12,683,948 2023 600,000 — 5,005,406 — 1,500,000 9,900 7,115,306 2022 600,000 — 25,552,061 — — 9,150 26,161,211 2021 11,538 250,000 — — — — 261,569 2023 1,000,000 — 10,010,679 — 3,000,000 9,900 14,020,579 2022 665,385 — 25,451,960 8,467,018 — 63,559 34,647,922 (1) The amounts reported in this column represent the aggregate grant date fair value of RSUs awarded to the named executive officers in 2021, 2022 and 2023, and PSUs awarded to the named executive officers in 2022, calculated in accordance with FASB ASC Topic 718. Such aggregate grant date fair values do not take into account any estimated forfeitures related to service-vesting conditions. These amounts do not reflect the actual economic value that may be realized from such awards. The amounts reported for the RSUs were calculated using the closing price of our common stock on the date of grant. The amounts reported for the PSUs assume the probable outcome of the applicable performance conditions on the date of grant (i.e., based on 100% of target level performance) and are estimated using the closing price of our common stock on the date of grant. The valuation assumptions used in determining such amounts are described in the Notes to our Consolidated Financial Statements included in our Annual Report on Form 10-K filed with the SEC on February 27, 2024. If the PSUs were instead valued based on the maximum outcome of the applicable performance conditions, the grant date fair value of the PSUs granted in this column for 2022 would be as follows: Mr. Lawson: $74,827,768; Mr. Shipchandler: $43,321,190; and Mr. Wagner: $19,691,651. Ms. Donio did not receive a PSU award. (2) The amounts reported in this column represent the aggregate grant date fair value of stock options granted in the applicable year computed in accordance with calculated in accordance with FASB ASC Topic 718. These amounts do not reflect the actual economic value that may be realized from such awards. The valuation assumptions used in determining such amounts are described in the Notes to our Consolidated Financial Statements included in our Annual Report on Form 10-K filed with the SEC on February 27, 2024. (3) The amounts reported in this column for 2023 represent matching contributions to each of our named executive officers’ 401(k) retirement plan accounts. (4) Mr. Lawson stepped down as our Chief Executive Officer and board chair effective January 8, 2024, and his employment with the Company ended on January 12, 2024. (5) Ms. Viggiano served as Senior Vice President of Finance from 2021 until March 1, 2023, at which time she became our Chief Financial Officer. The table reflects an increase in Ms. Viggiano’s base salary and additional equity awards issued in connection with her appointment as Chief Financial Officer in March 2023. (6) This amount includes one-time equity awards issued in March 2023 in connection with Ms. Viggiano’s appointment as Chief Financial Officer consisting of RSUs with a grant date fair value of $2,770,291. (7) Mr. Shipchandler served as Chief Financial Officer from 2018 to 2021, Chief Operating Officer from October 27, 2021 until March 1, 2023, and President, Twilio Communications from March 1, 2023 until his appointment as Chief Executive Officer effective January 8, 2024. The table reflects an increase in Mr. Shipchandler’s base salary and additional equity awards issued in connection with his appointment as Chief Operating Officer in October 2021. (8) Ms. Donio was appointed as our President of Revenue effective May 4, 2022 (after stepping down from our board of directors on April 29, 2022) and served as our President of Revenue until March 1, 2023, at which time she became our President, Twilio Data & Applications. Ms. Donio stepped down from her role as President, Twilio Data & Applications effective December 15, 2023, after which she remained employed in an advisory role until March 31, 2024. The table reflects salary amounts for 2022 for Ms. Donio that are prorated based on the number of days in 2022 during which she was employed by us and additional equity awards issued in June 2022 in connection with her appointment as President of Revenue. All of Ms. Donio’s compensation for 2022 relating to her service as a director is set forth in the “All Other Compensation” column. 2024 Proxy Statement

Executive Compensation Tables Name Type of Award Aidan Viggiano 2/22/2023 2/22/2023 — — — 92,789 6,117,579 2/22/2023 2/22/2023 — — — 46,395 3,058,822 2/22/2023 2/22/2023 1,375,000 2,750,000 2,750,000 — — 3/20/2023 3/15/2023 — — — 44,268 2,770,291 Khozema Shipchandler 2/22/2023 2/22/2023 — — — 101,225 6,673,764 2/22/2023 2/22/2023 — — — 50,613 3,336,915 2/22/2023 2/22/2023 1,500,000 3,000,000 3,000,000 — — Dana Wagner 2/22/2023 2/22/2023 — — — 50,613 3,336,915 2/22/2023 2/22/2023 — — — 25,307 1,668,491 2/22/2023 2/22/2023 750,000 1,500,000 1,500,000 — — Elena Donio 2/22/2023 2/22/2023 — — — 101,225 6,673,764 2/22/2023 2/22/2023 — — — 50,613 3,336,915 2/22/2023 2/22/2023 1,500,000 3,000,000 3,000,000 — — (1) The amounts reported in this column reflect the 2023 performance-based cash awards, which were granted under the 2016 Plan. For a description of the performance-based cash awards, including information on the threshold, target, maximum and actual award level achievement, as well as descriptions of the performance goals, see the section titled “Executive Compensation—Compensation Discussion and Analysis—Individual Compensation Elements—Annual Cash Incentives—2023 Performance-Based Cash Awards.” (2) For Ms. Donio and Messrs. Shipchandler and Wagner, the amounts reported in this column reflect the 2023 Annual RSUs, which were granted under the 2016 Plan. For Ms. Viggiano, the amounts reported in this column also reflect Ms. Viggiano’s promotional equity award, granted under the 2016 Plan to Ms. Viggiano in March 2023 connection with her appointment as Chief Financial Officer, as described in the section titled “Executive Compensation—Compensation Discussion and Analysis—Individual Compensation Elements—2023 Additional Executive Officer Promotional Award.” (3) The amounts reported in this column represent the aggregate grant date fair value of the RSUs granted to the named executive officers in 2023, calculated in accordance with FASB ASC Topic 718. Assumptions underlying the valuations are set forth in footnote 1 to the Summary Compensation Table above. These amounts do not reflect the actual economic value that may be realized from such awards. 2024 Proxy Statement Executive Compensation Tables

Name Jeff Lawson 316,667 — 10.09 12/30/2025 — — — — 163,890 — 31.96 2/9/2027 — — — — 203,589 — 33.01 2/19/2028 — — — — 110,697 — 111.32 1/30/2029 — — — — 114,767 — 117.94 2/21/2030 — — — — 22,526 11,606 377.59 2/24/2031 — — — — — — — — 6,238 473,277 — — — — — — 50,280 3,814,744 — — — — — — — — 158,427 12,019,856 Aidan Viggiano 3,794 272 126.71 2/20/2030 — — — — — — — — 202 15,326 — — 1,483 569 367.65 4/20/2031 — — — — — — — — 354 26,858 — — — — — — 5,764 437,315 — — — — — — 1,848 140,208 — — — — — — 8,380 635,791 — — — — — — — — 29,185 2,214,266 — — — — 92,789 7,039,901 — — — — — — 38,734 2,938,749 — — Khozema Shipchandler 35,418 — 76.63 10/31/2028 — — — — 44,158 — 117.94 2/21/2030 — — — — 11,964 6,162 377.59 2/24/2031 — — — — — — — — 3,314 251,433 — — 4,476 9,089 298.00 11/11/2031 — — — — — — — — 5,017 380,640 — — — — — — 29,329 2,225,191 — — — — — — — — 91,721 6,958,872 — — — — 101,225 7,679,941 — — Dana Wagner — — — — 32,961 2,500,751 — — — — — — 12,570 953,686 — — — — — — — — 41,692 3,163,172 — — — — 50,613 3,840,008 — — Elena Donio 62,680 104,470 85.17 6/21/2032 — — — — — — — — 186,351 14,138,450 — — — — — — 101,225 7,679,941 — — (1) Equity awards granted prior to June 21, 2016 were granted pursuant to our 2008 Stock Option Plan (as amended and restated, the “2008 Plan”). Each stock option under the 2008 Plan is immediately exercisable. Equity awards granted on or after June 21, 2016 were granted pursuant to our 2016 Plan. 2024 Proxy Statement

Executive Compensation Tables (2) Unless otherwise described in the footnotes below, the vesting of each equity award on a vesting date is subject to the applicable named executive officer’s continued employment with us through such vesting date. (3) This column represents the fair market value of a share of our common stock on the date of the grant, as determined by the administrator of our 2008 Plan or 2016 Plan, as applicable. (4) The market values of the unvested RSUs and unearned PSUs are calculated by multiplying the number of unvested or unearned units, respectively, by the closing price of our common stock, as reported on the NYSE, of $75.87 per share on December 29, 2023 (the last trading day of 2023). (5) The shares subject to the stock option are fully vested. (6) The shares subject to the stock option vest as follows: 33% of the shares subject to the stock option vest in equal quarterly installments between the first and second anniversaries of December 31, 2020, 33% of the shares subject to the stock option vest in equal quarterly installments between the second and third anniversaries of December 31, 2020 and 34% of the shares subject to the stock option vest in equal quarterly installments between the third and fourth anniversaries of December 31, 2020. In connection with the termination of Mr. Lawson’s employment as of January 12, 2024, all unvested stock options held by Mr. Lawson as of that date vested. (7) The RSUs vest as follows: 33% of the RSUs vest in equal quarterly installments between the first and second anniversaries of December 31, 2020, 33% of the RSUs vest in equal quarterly installments between the second and third anniversaries of December 31, 2020 and 34% of the RSUs vest in equal quarterly installments between the third and fourth anniversaries of December 31, 2020. In connection with the termination of Mr. Lawson’s employment as of January 12, 2024, all unvested RSUs held by Mr. Lawson as of that date vested. (8) The RSUs vest as follows: 33% of the RSUs vest in equal quarterly installments between the first and second anniversaries of January 1, 2022, 33% of the RSUs vest in equal quarterly installments between the second and third anniversaries of January 1, 2022, and 34% of the RSUs vest in equal quarterly installments between the third and fourth anniversaries of January 1, 2022. In connection with the termination of Mr. Lawson’s employment as of January 12, 2024, all unvested RSUs held by Mr. Lawson as of that date vested. (9) The PSUs vest in three tranches subject to the achievement of certain performance metrics for 2022, 2023 and 2024. The 2023 and 2024 tranches are eligible to vest if both (i) the minimum organic revenue growth threshold and (ii) the non-GAAP income from operations threshold are achieved for 2023 and 2024, respectively. Vesting of these PSUs will range up to 100% above the target based on levels of performance. On February 16, 2024, none of the 2023 tranche of PSUs subject to these awards were deemed earned and vested based on our performance for 2023. As a result, the following number of PSUs were outstanding as of December 31, 2023 but were forfeited on February 16, 2024 based on our performance for 2023: 14,592 of these PSUs for Ms. Viggiano, 45,860 of these PSUs for Mr. Shipchandler, and 20,846 of these PSUs for Mr. Wagner. In connection with the termination of Mr. Lawson’s employment as of January 12, 2024, all unvested PSUs held by Mr. Lawson as of that date were forfeited to us. (10) (11) (12) (13) (14) (15) (16) The RSUs vest as follows: 33% of the RSUs vest in equal quarterly installments between the first and second anniversaries of January 1, 2023, 33% of the RSUs vest in equal quarterly installments between the second and third anniversaries of January 1, 2023, and 34% of the RSUs vest in equal quarterly installments between the third and fourth anniversaries of January 1, 2023. (17) (18) The shares subject to the stock option vest as follows: 33% of the shares subject to the stock option vest in equal quarterly installments between the first and second anniversaries of December 31, 2021, 33% of the shares subject to the stock option vest in equal quarterly installments between the second and third anniversaries of December 31, 2021 and 34% of the shares subject to the stock option vest in equal quarterly installments between the third and fourth anniversaries of December 31, 2021. (19) The RSUs vest as follows: 33% of the RSUs vest in equal quarterly installments between the first and second anniversaries of December 31, 2021, 33% of the RSUs vest in equal quarterly installments between the second and third anniversaries of December 31, 2021 and 34% of the RSUs vest in equal quarterly installments between the third and fourth anniversaries of December 31, 2021. (20) The RSUs vest as follows: 29.17% of the RSUs vest on February 15, 2023 and the remaining RSUs vest quarterly over the next eleven quarters on February 15, May 15, August 15 and November 15, with a final vesting of 2.08% of the RSUs on February 15, 2026. (21) (22) 2024 Proxy Statement Executive Compensation Tables

Option Awards Stock Awards Name Jeff Lawson — — 128,309 8,471,120 Aidan Viggiano — — 79,090 5,142,449 Khozema Shipchandler — — 125,869 8,317,305 Elena Donio — — 125,153 7,761,629 Dana Wagner — — 67,853 4,374,418 (1) The aggregate value realized upon the vesting and settlement of the RSUs and PSUs represents the aggregate market price of the shares of our common stock that vested on the date of settlement. 2024 Proxy Statement

Executive Compensation Tables 2024 Proxy Statement Executive Compensation Tables

2024 Proxy Statement

Executive Compensation Tables Name Payment Elements Jeff Lawson Salary — Continued Benefits — Total 2,584,199 16,617,313 6,009,890 Aidan Viggiano Salary — — Continued Benefits — Performance-Based Cash — — Total 869,886 17,503,242 1,107,095 Salary — — Continued Benefits — Performance-Based Cash — — Total 1,119,886 22,175,906 3,479,398 Dana Wagner Salary — — Continued Benefits — Performance-Based Cash — — Total 608,041 12,869,679 1,581,586 Elena Donio Salary — — Continued Benefits — Performance-Based Cash — — Total 1,019,886 26,348,220 — (1) A “qualifying termination” means a termination other than due to cause, death or disability (or a resignation for good reason) and “not in connection with a change in control” means outside of the change in control period. (2) A “qualifying termination” means a termination other than due to cause, death or disability or a resignation for good reason and “in connection with a change in control” means within the change in control period. Assumes that in connection with the change in control, outstanding equity awards and the 2023 performance-based cash awards would have otherwise been assumed, substituted or continued by the successor entity. (3) Represents the market value of the shares underlying the stock options, RSUs and PSUs as of December 31, 2023, based on the closing price of our common stock, as reported on the NYSE, of $75.87 per share on December 29, 2023 (the last trading day of 2023). 2024 Proxy Statement Executive Compensation Tables

(4) See “—Other Compensation Policies and Practices—Death Equity Acceleration Policy” which discusses the treatment of equity awards upon the termination due to death of an employee’s or non-employee director’s employment or other service relationship with us or any of our subsidiaries. (5) Represents 18 months of our Chief Executive Officer’s 2022 annual base salary. (6) Represents 24 months of our Chief Executive Officer’s 2022 annual base salary. (7) Represents 12 months of accelerated vesting for outstanding and unvested time-based equity awards. (8) Represents acceleration of vesting of 100% of the total number of shares underlying outstanding and unvested time-based equity awards, and vesting of PSUs for the 2023 and 2024 performance periods based on the target level of performance. (9) Represents the vesting of outstanding PSUs for the fiscal year 2023 performance period upon a change in control and assumes such PSUs vest at the target level of performance. (10) Represents 18 months of our contribution towards health insurance, based on our actual costs to provide health insurance to the applicable named executive officer immediately prior to termination. (11) Represents 24 months of our contribution towards health insurance, based on our actual costs to provide health insurance to our Chief Executive Officer immediately prior to termination. (12) Represents 12 months of the applicable named executive officer’s 2023 annual base salary as in effect immediately prior to termination. (13) Represents 18 months of the applicable named executive officer’s 2023 annual base salary as in effect immediately prior to termination. (14) Represents 12 months of our contribution toward health insurance, based on our actual costs to provide health insurance to the applicable named executive officer immediately prior to termination. (15) Represents 100% of the cash payment for the applicable named executive officer’s 2023 performance cash award. (16) Represents payments and benefits to which Mr. Shipchandler was entitled as of December 31, 2023 pursuant to the Senior Executive Severance Plan. Following the CEO Transition, Mr. Shipchandler is party to the Amended Chief Executive Officer Severance Plan. 2024 Proxy Statement

2024 Proxy Statement

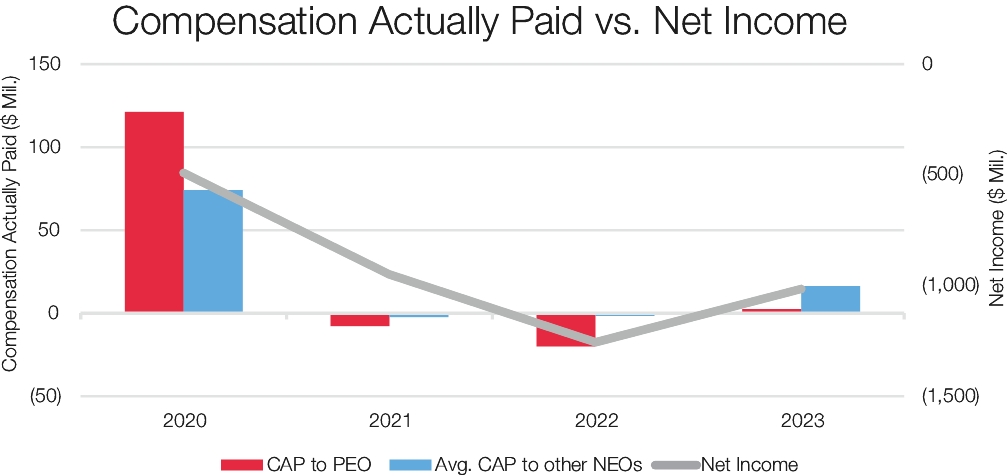

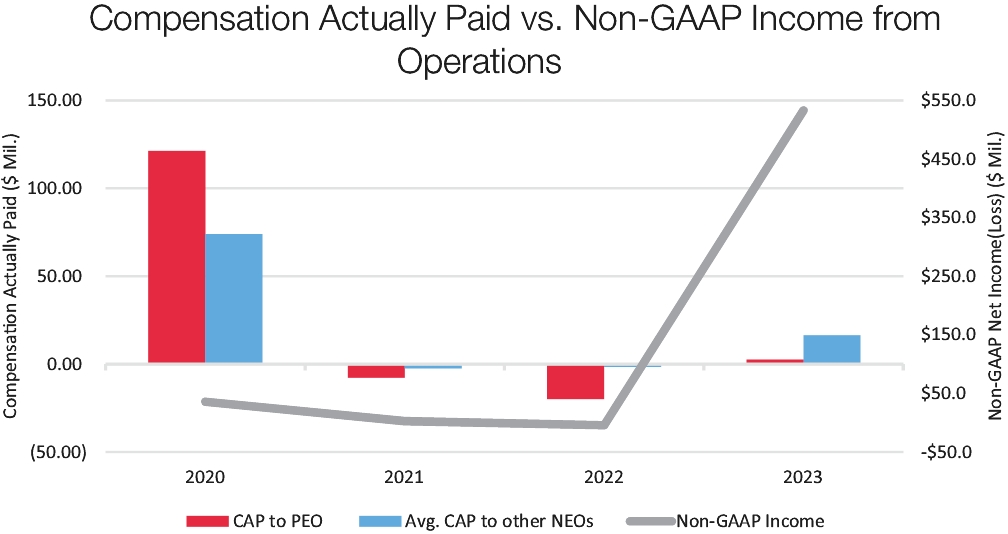

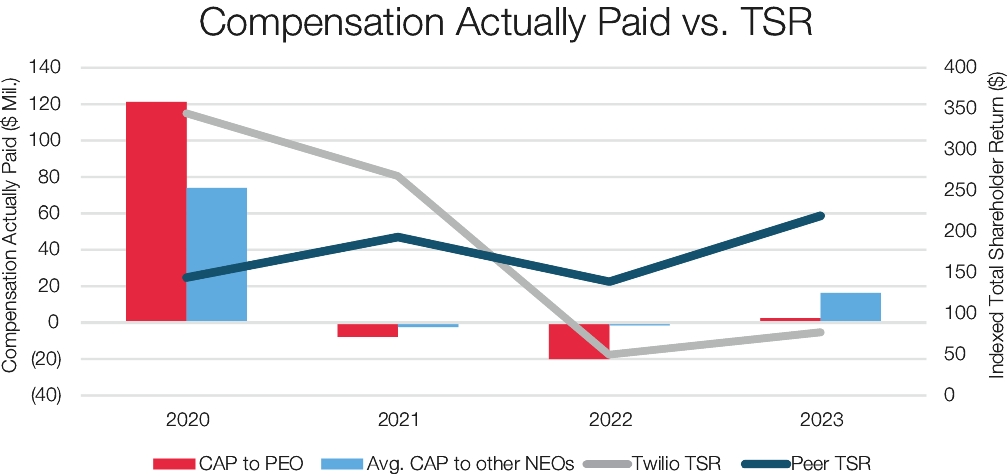

Year (a) (b) (c) (d) (e) (f) (g) (h) (i) 2023 $12,689,130 $16,376,998 $219 ($1,015) $533.0 2022 $49,377,469 $29,982,991 $139 ($1,256) 2021 $14,625,745 $14,523,754 $268 $194 2020 $13,786,872 $121,274,654 $74,018,467 $344 $144 (1) Jeff Lawson served as our PEO for the entirety of 2023, 2022, 2021 and 2020. The dollar amounts reported in column (b) are the amounts of total compensation reported for Mr. Lawson for each corresponding year in the “Total” column of the Summary Compensation Table. Refer to “Executive Compensation—Executive Compensation Tables—Summary Compensation Table.” (2) The dollar amounts reported in column (c) represent the amount of “compensation actually paid” to Mr. Lawson, as computed in accordance with Item 402(v) of Regulation S-K. The company has not paid dividends historically and does not sponsor any pension arrangements; thus no adjustments are made for these items. The dollar amounts do not reflect the actual amount of compensation earned by or paid to Mr. Lawson during the applicable year. In accordance with the requirements of Item 402(v) of Regulation S-K, the following adjustments were made to Mr. Lawson’s total compensation for 2023 to determine the compensation actually paid: Year 2023 $76,859 — $2,416,839 $2,493,698 (a) The reported value of equity awards represents the total of the amounts reported in the “Stock Awards” and “Option Awards” columns in the Summary Compensation Table for 2023. 2024 Proxy Statement

Pay Versus Performance (b) The equity award adjustments for 2023 include the addition (or subtraction, as applicable) of the following: (i) the year-end fair value of any equity awards granted in 2023 that are outstanding and unvested as of the end of 2023; (ii) the amount of change as of the end of 2023 (from the end of 2022) in fair value of any awards granted in prior years that are outstanding and unvested as of the end of 2023; (iii) for awards that are granted and vest in 2023, the fair value as of the vesting date; (iv) for awards granted in prior years that vest in 2023, the amount equal to the change as of the vesting date (from the end of 2022) in fair value; (v) for awards granted in prior years that are determined to fail to meet the applicable vesting conditions during 2023, a deduction for the amount equal to the fair value at the end of 2022; and (vi) the dollar value of any dividends or other earnings paid on stock or option awards in 2023 prior to the vesting date that are not otherwise reflected in the fair value of such award or included in any other component of total compensation for 2023. The valuation assumptions used to calculate fair values did not materially differ from those disclosed at the time of grant. The amounts deducted or added in calculating the equity award adjustments are as follows: Year 2023 — ($132,725) — $2,549,564 — — $2,416,839 (3) The dollar amounts reported in column (d) represent the average of the amounts reported for our NEOs as a group (other than Mr. Lawson) in the “Total” column of the Summary Compensation Table in each applicable year. Our NEOs included in this calculation for each year are: (4) The dollar amounts reported in column (e) represent the average amount of “compensation actually paid” to the NEOs as a group (other than Mr. Lawson), as computed in accordance with Item 402(v) of Regulation S-K. The dollar amounts do not reflect the actual average amount of compensation earned by or paid to the NEOs as a group (other than Mr. Lawson) during the applicable year. The company has not paid dividends historically and does not sponsor any pension arrangements; thus no adjustments are made for these items. In accordance with the requirements of Item 402(v) of Regulation S-K, the following adjustments were made to average total compensation for the NEOs as a group (other than Mr. Lawson) for 2023 to determine the compensation actually paid, using the same methodology described above in Note 2: Year 2023 $12,689,130 ($9,243,364) $12,931,233 $16,376,998 (a) The amounts deducted or added in calculating the total average equity award adjustments are as follows: Year 2023 $7,294,635 $1,813,018 $2,945,681 $877,898 — — $12,931,233 (5) TSR is determined based on the value of an initial fixed investment of $100 in our Class A common stock on December 31, 2019, assuming the reinvestment of any dividends. (6) The peer group used for this purpose is the following published industry index: S&P 500 Information Technology Index, which is an industry index reported in our most recent Annual Report on Form 10-K. (7) The dollar amounts reported represent the amount of net income reflected in our audited financial statements for the applicable year. 2024 Proxy Statement Pay Versus Performance

(8) Non-GAAP income from operations is a non-GAAP financial measure. Refer to Appendix B for its definition. While we use numerous financial and non-financial performance measures for the purpose of evaluating performance for our compensation programs, we have determined that non-GAAP income from operations is the financial performance measure that, in our assessment, represents the most important performance measure (that is not otherwise required to be disclosed in the table) used by the company to link compensation actually paid to our NEOs, for the most recently completed fiscal year, to company performance.

2024 Proxy Statement

Plan Category 213,957 $42.97 — Total 20,478,399 $71.13 28,410,961 (1) Includes the following plans: our 2008 Plan, 2016 Plan, and our ESPP. We no longer make grants subject to our 2008 Plan. (2) Consists of stock options, RSUs, PSUs and DSUs. The number of PSUs included in this amount for the 2023 and 2024 performance periods reflects the number of shares that would be earned assuming 100% of target level performance. However, in February 2024, upon certification by the compensation committee of performance for the 2023 performance period, no shares were earned, and the actual number of shares that will be issued for the 2024 performance period depends on the performance over the 2024 performance period. (3) Excludes shares issuable upon vesting of outstanding RSUs, PSUs and DSUs as of December 31, 2023, since they have no exercise price. (4) As of December 31, 2023, a total of 19,869,260 shares of our common stock were reserved for issuance pursuant to the 2016 Plan. This number includes 3,783,548 shares of our common stock reserved and available for issuance under the SendGrid 2009 Plan, the SendGrid 2012 Plan and the SendGrid 2017 Plan that we assumed, which were approved by the stockholders of SendGrid, but not by a separate vote of our stockholders; such shares became available for issuance under our 2016 Plan, but awards using such shares may not be granted to individuals who were employed, immediately prior to the acquisition, by us or our subsidiaries. The 2016 Plan provides that the number of shares reserved and available for issuance under the 2016 Plan will automatically increase each January 1, beginning on January 1, 2017, by 5% of the outstanding number of shares of our common stock on the immediately preceding December 31 or such lesser number of shares as determined by our compensation committee. As of December 31, 2023, a total of 8,541,701 shares of our common stock were available for future issuance pursuant to the ESPP, including shares of our common stock subject to purchase during the current purchase period as of such date, which commenced on November 16, 2023 (the exact number of which will not be known until the purchase date on May 15, 2024). The ESPP provides that the number of shares reserved and available for issuance under the ESPP will automatically increase each January 1, beginning on January 1, 2017, by the lesser of 1,800,000 shares of our common stock, 1% of the outstanding number of shares of our common stock on the immediately preceding December 31 or such lesser number of shares as determined by our compensation committee. (5) Includes shares of our common stock to be issued upon outstanding stock option and RSU awards under the following plans, which awards were assumed in connection with our acquisitions of SendGrid, Segment.io, Inc. (“Segment”) and Zipwhip Inc. (“Zipwhip”): SendGrid’s Amended and Restated 2009 Equity Incentive Plan, Amended and Restated 2012 Equity Incentive Plan, and Amended and Restated 2017 Equity Incentive Plan; Segment’s Fifth Amended and Restated 2013 Stock Option and Grant Plan; and Zipwhip’s 2008 Stock Plan and 2018 Equity Incentive Plan. No further grants may be made under any of these plans. 2024 Proxy Statement

Shares of Common Stock Beneficially Owned Name of Beneficial Owner # % Named Executive Officers and Directors: 189,507 * * * 6,931,219 3.9% * Charles Bell — — 533,113 * 9,451 * 26,484 * Jeffrey Immelt 27,231 * Deval Patrick 2,058 * 33,612 * 2024 Proxy Statement Security Ownership of Certain Beneficial Owners and Management

Shares of Common Stock Beneficially Owned Name of Beneficial Owner # % Andrew Stafman — — Miyuki Suzuki 8,250 * 5% Stockholders: 17,809,500 10.0% 10,512,625 5.9% * Represents less than 1%. (1) Consists of (i) 90,832 shares of Class A common stock held by Mr. Shipchandler and (ii) 98,675 shares of Class A common stock subject to outstanding options that are exercisable within 60 days of March 31, 2024. (2) Consists of (i) 35,307 shares of Class A common stock held by Ms. Viggiano, (ii) 5,768 shares of Class A common stock subject to outstanding options that are exercisable within 60 days of March 31, 2024, and (iii) 3,892 shares of Class A common stock issuable upon the settlement of RSUs that are releasable within 60 days of March 31, 2024. (3) Consists of (i) 46,141 shares of Class A common stock held by Mr. Wagner and (ii) 3,956 shares of Class A common stock issuable upon the settlement of RSUs that are releasable within 60 days of March 31, 2024. (4) Consists of (i) 4,964,772 shares of Class A common stock held by Mr. Lawson and Erica Freeman Lawson, as trustees of the Lawson Revocable Trust dated 10/2/11, (ii) 1,022,705 shares of Class A common stock held by J.P. Morgan Trust Company, as trustee of the Lawson 2014 Irrevocable Trust dated 12/29/2014, and (iii) 943,742 shares of Class A common stock subject to outstanding options that are exercisable within 60 days of March 31, 2024. (5) Consists of (i) 125,604 shares of Class A common stock held by Ms. Donio and (ii) 73,126 shares of Class A common stock subject to outstanding options that are exercisable within 60 days of March 31, 2024. (6) Consists of (i) 25,853 shares of Class A common stock held by Mr. Deeter and (ii) 507,260 shares of Class A common stock held by Mr. Deeter and Allison K. Deeter, as trustees of the Deeter Family Trust dated 07/28/2000. (7) Consists of 9,451 shares of Class A Common stock held by Ms. Dubinsky, as trustee of the Shustek-Dubinsky Family Trust. (8) Consists of 26,484 shares of Class A common stock held by Mr. Epstein, as trustee of the Epstein Family Revocable Trust. (9) Consists of 33,612 shares of Class A common stock held of record by Ms. Rottenberg, as trustee of the Erika Rottenberg Revocable Trust dated 1/28/2016. (10) Consists of (i) 6,925,560 shares of Class A common stock, (ii) 1,121,311 shares of Class A common stock subject to outstanding stock options that are exercisable within 60 days of March 31, 2024, and (iii) 7,848 shares of Class A common stock issuable upon the settlement of RSUs that are releasable within 60 days of March 31, 2024. (11) Based on information reported by The Vanguard Group on Schedule 13G/A filed with the SEC on February 13, 2024. Of the shares of Class A common stock beneficially owned, The Vanguard Group reported that it has sole dispositive power with respect to 17,423,882 shares, shared dispositive power with respect to 385,618 shares and shared voting power with respect to 117,782 shares. The Vanguard Group listed its address as 100 Vanguard Blvd., Malvern, Pennsylvania 19355. (12) Based on information reported by BlackRock, Inc. on Schedule 13G/A filed with the SEC on January 29, 2024. Of the shares of Class A common stock beneficially owned, Blackrock, Inc. reported that it has sole dispositive power with respect to 10,512,625 shares and sole voting power with respect to 9,486,684 shares. BlackRock, Inc. listed its address as 50 Hudson Yards, New York, New York 10001. 2024 Proxy Statement

•2017;•ratifyapprove, on a non-binding advisory basis, the compensation of our 2016 Stock Optionnamed executive officers; Incentive Plan to preserve our ability to receive corporate income tax deductions that may become available pursuant to Section 162(m) of the Code; and•any•"FOR" the election of Richard Dalzell and Erika Rottenberg as Class I directors;•"FOR" the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2017; and•"FOR" the ratification of our 2016 Stock Option and Incentive Plan.• • • • • either class of our Class A common stock as of the close of business on April 17, 2017,15, 2024, the record date for the Annual Meeting, may vote at the Annual Meeting. As of the record date, there were 61,580,643174,630,253 shares of our Class A common stock outstanding and there were 28,653,832 shares ofour Class B common stock outstanding. Our Class A common stock and Class B common stock will vote as a single class on all matters described in this proxy statement for which your vote is being solicited. Stockholders are not permitted to cumulate votes with respect to the election of directors. Each share of Class A common stock is entitled to one vote on each proposal and each share of Class B common stock is entitled to 10 votes on each proposal. Our Class A common stock and Class B common stock are collectively referred to in this proxy statement as our "common stock."2024 Proxy Statement

liveby Internet at the Annual Meeting. Throughout this proxy statement, we refer to these registered stockholders as "stockholders“stockholders of record.""street“street name,"” and the Notice was forwarded to you by your broker or nominee, who is considered the stockholder of record with respect to those shares. As the beneficial owner, you have the right to direct your broker, bank or other nominee as to how to vote your shares. Beneficial owners are also invited to attend the Annual Meeting. However, since a beneficial owner is not the stockholder of record, you may not vote your shares of our common stock liveby Internet at the Annual Meeting unless you follow your broker'sbroker’s procedures for obtaining a legal proxy. If you request a printed copy of our proxy materials by mail, your broker, bank or other nominee will provide a voting instruction form for you to use. Throughout this proxy statement, we refer to stockholders who hold their shares through a broker, bank or other nominee as "street“street name stockholders."•Proposal No. 1: The election of directors requires• • • • • 2024 Proxy Statement

stock present in person or by proxy at the Annual Meeting and entitled to vote thereon to be approved. "Plurality" means that the nominees who receive the largest number of votes cast "For" such nominees are elected as directors. As a result, any shares not voted "For" a particular nominee (whether as a result of stockholder abstention or a broker non-vote) will not be counted in such nominee's favor and will have no effect on the outcome of the election.stock. You may vote "For"“For,” “Against” or "Withhold" on each of the nominees for election as a director.•Proposal No. 2: The ratification of the appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2017 requires the affirmative vote of a majority of the voting power of the shares of our common stock present in person or by proxy at the Annual Meeting“Abstain” with respect to this proposal. Abstentions and entitled to vote thereon to be approved. Abstentionsbroker non-votes are considered shares present and entitled to vote on this proposal, and thus, will have the same effect as a vote "Against"“Against” this proposal. Broker non-votes will have no effect on the outcome of this proposal.•Proposal No. 3. Under our amended and restated certificate of incorporation and amended and restated bylaws, the ratification of our 2016 Stock Option and Incentive Plan, or 2016 Plan, to preserve our ability to receive corporate income tax deductions that may become available pursuant to Section 162(m) of the Internal Revenue Code of 1986, as amended, or Code, requires the affirmative vote of a majority of the voting power of the shares of our common stock present in person or by proxy at the Annual Meeting and entitled to vote thereon to be approved. Abstentions are considered shares present and entitled to vote on this proposal, and thus, will have the same effect as a vote "Against" this proposal. Broker non-votes will have no effect on the outcome of this proposal. In addition, the rules of the New York Stock Exchangerequire that an additional threshold be met for this proposal to be approved: votes for this proposal must be at least a majority of all of the votes cast on this proposal. The New York Stock Exchange treats abstentions both as shares entitled to vote and as votes cast, but does not treat broker non-votes as votes cast. Because this proposal is a non-routine matter under the rules of the New York Stock Exchange, brokerage firms, banks and other nominees who hold shares on behalf of clients in "street name" are not permitted to vote the shares if the client does not provide instructions.amended and restated bylaws and Delaware law. The presence, in personvirtually or by proxy, of the holders of a majority of the voting power of all issued and outstanding shares of our common stock entitled to vote at the Annual Meeting will constitute a quorum at the Annual Meeting. Abstentions, withholdwithheld votes and broker non-votes are counted as shares present and entitled to vote for purposes of determining a quorum.•11:8:59 p.m. EasternPacific Time on June 11, 20175, 2024 (have your Notice or proxy card in hand when you visit the website);• toll-free telephone at 1-800-690-6903, until 11:8:59 p.m. EasternPacific Time on June 11, 20175, 2024 (have your Notice or proxy card in hand when you call);•mailingreturning your proxy card by mail prior to 8:59 p.m. Pacific Time on June 5, 2024 (if you received printed proxy materials); or•written ballot atInternet during the Annual Meeting.telephoneInternet or on the Internet.telephone. However, the availability of telephoneInternet and Internettelephone voting will depend on the voting process of your broker, bank or other nominee. As discussed above, if you are a street name stockholder, you may not vote your shares in personby Internet at the Annual Meeting unless you obtain a legal proxy from your broker, bank or other nominee.•••Twilio Inc., 375 Beale101 Spear Street, Suite 300,Fifth Floor, San Francisco, California 94105; or•2024 Proxy Statement

dobe able to attend the Annual Meeting in person?plan to attend the meeting, you must beare a holder of Company sharesstockholder as of the record date of April 17, 2017. On15, 2024 and wish to virtually attend the day of the meeting, each stockholder will be required to present the following:•valid government photo identification, such as a driver's license or passport; and•street name stockholders holding their shares through a broker, bank, trustee, or other nomineeAnnual Meeting, you will need to bring proofthe 16-digit control number located on your Notice of beneficial ownership asInternet Availability of April 17, 2017, the record date, such as their most recent account statement reflecting their stock ownership prior to April 17, 2017,Proxy Materials or on your proxy card (if you receive a printed copy of the voting instruction card providedproxy materials). If you are a street name stockholder, you may not vote your shares of our common stock by their broker, bank, trustee, or other nominee, or similar evidence of ownership. Seating will begin at 8:00 a.m. and the meeting will begin at 9:00 a.m. Please note that seating is limited and you will be permitted entry on a first-come, first-served basis. Use of cameras, recording devices, computers and other personal electronic devices will not be permittedInternet at the Annual Meeting as all photography and video are prohibited atunless you follow your broker’s procedures for obtaining a legal proxy. Instructions on how to participate in the Annual Meeting. AllowMeeting are also posted online at www.proxyvote.com. The webcast will start at 8:30 a.m. Pacific Time on June 6, 2024. We encourage you to access the meeting prior to the start time. Online check-in will begin at 8:15 a.m. Pacific Time, and you should allow ample time for check-in. Parking is limited. Please consider using public transportation. For security reasons, large bags and packages will not be allowed at the Annual Meeting. Persons may be subjectcheck-in procedures.search.Jeff Lawson, Lee KirkpatrickKhozema Shipchandler, our Chief Executive Officer and Karyn SmithDirector, and Dana Wagner, our Chief Legal Officer, Chief Compliance Officer and Corporate Secretary, have been designated as proxy holders by our board of directors. When proxies are properly dated, executed and returned, the shares represented by such proxies will be voted at the Annual Meeting in accordance with the instructions of the stockholder. If no specific instructions are given, however, the shares will be voted in accordance with the recommendations of our board of directors as described above. If any matters not described in this proxy statement are properly presented at the Annual Meeting, the proxy holders will use their own judgment to determine how to vote the shares. If the Annual Meeting is adjourned, the proxy holders can vote the shares on the new Annual Meeting date as well, unless you have properly revoked your proxy instructions, as described above.("SEC"(“SEC”), we have elected to furnish our proxy materials, including this proxy statement and our annual report, primarily via the Internet. The Notice containing instructions on how to access our proxy materials is first being mailed on or about April 24, 201726, 2024 to all stockholders entitled to vote at the Annual Meeting. Stockholders may request to receive all future proxy materials in printed form by mail or electronically by e-mailemail by following the instructions contained in the Notice. We encourage stockholders to take advantage of the availability of our proxy materials on the Internet to help reduce the environmental impact and cost of our annual meetings of stockholders. 2024 Proxy Statement Table of ContentsTABLE OF CONTENTS

"routine"“routine” matter: the proposal to ratify the appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2017.2024. Your broker will not have discretion to vote your shares on any other proposals, which are "non-routine"“non-routine” matters, absent direction from you."householding,"“householding,” which the SEC has approved. Under this procedure, we deliver a single copy of the Notice and, if applicable, our proxy materials, to multiple stockholders who share the same address, unless we have received contrary instructions from one or more of such stockholders. This procedure reduces our printing costs, mailing costs and fees. Stockholders who participate in householding will continue to be able to access and receive separate proxy cards. Upon written or oral request, we will promptly deliver promptly a separate copy of the Notice and, if applicable, our proxy materials, to any stockholder of record at a shared address to which we delivered a single copy of any of these materials. To receive a separate copy, or, if a stockholder of record is receiving multiple copies, to request that we only send a single copy of the Notice and, if applicable, our proxy materials, such stockholder may contact us at:TwilioBroadridge Financial Solutions, Inc.Attention: Investor Relations375 Beale Street, Suite 300San Francisco, California 941052024 Proxy Statement Table of ContentsTABLE OF CONTENTS

year'syear’s annual meeting of stockholders or to nominate individuals to serve as directors?year'syear’s annual meeting of stockholders by submitting their proposals in writing to our Corporate Secretary in a timely manner. For a stockholder proposal to be considered for inclusion in our proxy statement for the 20182025 annual meeting of stockholders, our Corporate Secretary must receive the written proposal at our principal executive offices not later than March 10, 2018.December 27, 2024. In addition, stockholder proposals must comply with the requirements of Rule 14a-8 regarding the inclusion of stockholder proposals in company-sponsored proxy materials. Stockholder proposals should be addressed to:375 BealeSuite 300

Fifth Floor amended and restated bylaws also establish an advance notice procedure for stockholders who wish to present a proposal before an annual meeting of stockholders but do not intend for the proposal to be included in our proxy statement. Our amended and restated bylaws provide that the only business that may be conducted at an annual meeting of stockholders is business that is (i) specified inbrought pursuant to our proxy materials with respect to such annual meeting, (ii) otherwise properly brought before such annual meeting by or at the direction of our board of directors or (iii) properly brought before such annual meeting by a stockholder of record entitled to vote at such annual meeting who has delivered timely written notice to our Corporate Secretary, which notice must contain the information specified in our amended and restated bylaws. To be timely for the 20182025 annual meeting of stockholders, our Corporate Secretary must receive the written notice at our principal executive offices:•the close of business on February 8, 2018;10, 2025; and•the close of business on March 10, 2018.20182025 annual meeting of stockholders more than 30 days before or more than 60 days after the one-year anniversary of the Annual Meeting, then, for notice by the stockholder to be timely, it must be received by the secretaryCorporate Secretary not earlier than the close of business on the 120th day prior to such annual meeting and not later than the close of business on the later of the 90th day prior to such annual meeting, or the tenth10th day following the day on which public announcement of the date of such annual meeting is first made.nominee'snominee’s name and qualifications for membership on our board of directors and should be directed to our General Counsel or legal departmentChief Legal Officer at the address set forth above. For additional information regarding stockholder recommendations for director candidates, see the section titled "Board“Board of Directors and Corporate Governance—Stockholder Recommendations and Nominations to the Board of Directors."” amended and restated bylaws permit stockholders to nominate directors for election at an annual meeting of stockholders. To nominate a director, the stockholder must provide the information required by our amended and restated bylaws. In addition, the stockholder must give timely notice to our Corporate Secretary in accordance with our amended and restated bylaws, which, in general, require that the notice be received by our Corporate Secretary within the time periods described above under the section titled "Stockholder Proposals"“Stockholder Proposals” for stockholder proposals that are not intended to be included in a proxy statement. 2024 Proxy Statement

amended and restated bylaws is available via the SEC'sSEC’s website at http://www.sec.gov. You may also contact our Corporate Secretary at the address set forth above for a copy of the relevant bylaw provisions regarding the requirements for making stockholder proposals and nominating director candidates.2024 Proxy Statement BOARD OF DIRECTORS AND CORPORATE GOVERNANCE Our business and affairs are managed under the direction of our board of directors. Our board of directors consists of seven directors, all of whom, other than Messrs. Lawson and Deeter, qualify as "independent" under the listing standards of the New York Stock Exchange. Our board of directors is divided into three staggered classes of directors. At each annual meeting of stockholders, a class of directors will be elected for a three-year term to succeed the class whose term is then expiring. The following table sets forth the names, ages as of March 31, 2017, and certain other information for each of the members of our board of directors with terms expiring at the Annual Meeting (who, with the exception of Mr. Raney, are also nominees for election as a director at the Annual Meeting) and for each of the continuing members of our board of directors: Class Age Position Director

Since Current

Term

Expires Expiration

of Term

For Which

Nominated I 60 Director 2014 2017 2020 I 47 Director 2013 2017 — I 54 Director 2016 2017 2020

II 39 Co-Founder, Chief Executive Officer and Chairperson 2008 2018 — II 42 Director 2010 2018 — III 47 Director 2016 2019 — III 50 Director 2012 2019 —

†On April 12, 2017, Mr. Raney notified us of his decision not to stand for reelection to our board of directors at the Annual Meeting.(1)Member of the nominating and corporate governance committee(2)Member of the audit committee(3)Member of the compensation committee

Nominees for Director

Richard Dalzell. Mr. Dalzell has served as a member of our board of directors since 2014. From 1997 to 2007, Mr. Dalzell served in several roles at Amazon.com, Inc., including as Senior Vice President of Worldwide Architecture and Platform Software and Chief Information Officer. From 1990 to 1997, Mr. Dalzell served in several roles at Wal-Mart Stores, Inc., a discount retailer, including as Vice President of the Information Systems Division. Mr. Dalzell currently serves on the board of directors of Intuit Inc., a software company. Mr. Dalzell previously served on the board of directors of AOL Inc. Mr. Dalzell holds a B.S. in Engineering from the United States Military Academy.

Mr. Dalzell was selected to serve on our board of directors because of his experience as an executive and director of technology companies.

Erika Rottenberg. Ms. Rottenberg has served as a member of our board of directors since 2016. From 2008 to 2014, Ms. Rottenberg served as Vice President, General Counsel and Secretary at LinkedIn Corporation, a professional networking company. From 2004 to 2008, Ms. Rottenberg served as Senior Vice President, General Counsel and Secretary at SumTotal Systems, Inc., a talent management enterprise software company. From 1996 to 2002, Ms. Rottenberg served in several roles at Creative Labs, Inc., a computer peripheral and digital entertainment product company, including as

Table of ContentsTABLE OF CONTENTS

Vice President, Strategic Development and General Counsel. From 1993 to 1996, Ms. Rottenberg served as an attorney at Cooley LLP, a law firm. Ms. Rottenberg currently serves on the board of directors of Wix.com Ltd., a cloud-based web development platform. Ms. Rottenberg holds a B.S. in Special and Elementary Education from the State University of New York at Geneseo and a J.D. from the University of California, Berkeley, Boalt Hall School of Law.

Ms. Rottenberg was selected to serve on our board of directors because of her experience as a senior executive of technology companies and as a director of publicly-held technology companies.

Continuing Directors

Jeff Lawson. See the section titled "Executive Officers" for Mr. Lawson's biographical information.

Byron Deeter. Mr. Deeter has served as a member of our board of directors since 2010. Since 2005, Mr. Deeter has served as a partner of Bessemer Venture Partners, a venture capital firm. From 2004 to 2005, Mr. Deeter served as a director at International Business Machines Corporation, or IBM, a technology and consulting company. From 2000 to 2004, Mr. Deeter served in several roles, including co-founder, President, Chief Executive Officer and Vice President of Business Development, at Trigo Technologies, Inc., a product information management company, which was acquired by IBM in 2004. From 1998 to 2000, Mr. Deeter served as an Associate at TA Associates, a private equity firm. From 1996 to 1998, Mr. Deeter served as an Analyst at McKinsey & Company, a business consulting firm. Mr. Deeter previously served on the board of directors of Cornerstone OnDemand, Inc., a talent management software company and Instructure, Inc., an educational technology company. Mr. Deeter holds a B.A. in Political Economy from the University of California, Berkeley.

Mr. Deeter was selected to serve on our board of directors because of his experience in the venture capital industry and as a director of publicly-held and privately-held technology companies.

Elena Donio. Ms. Donio has served as a member of our board of directors since 2016. Since 2016, Ms. Donio has served as Chief Executive Officer at Axiom Global, a leading provider of tech-enabled legal services. From 1998 to 2016, Ms. Donio served in several roles, including as President, Executive Vice President and General Manager of Worldwide Small and Mid-Sized Businesses, at Concur Technologies, Inc., a business travel and expense management software company, which was acquired by SAP SE in 2014. From 1995 to 1997, Ms. Donio served as Senior Manager at Deloitte Consulting LLP, a professional services firm. From 1992 to 1995, Ms. Donio served as Senior Consultant at Andersen Consulting LLP, a business consulting firm. Ms. Donio holds a B.A. in Economics from the University of California, San Diego.

Ms. Donio was selected to serve on our board of directors because of her experience as a senior executive of a technology company and her industry experience.